Content

A different TIN can certainly be you’ll need for particular customers (find International TIN dependence on members, later). TIN must be to your a great withholding certification from a person stating to be some of the following the. The brand new number described above to possess a vow of indebtedness try withholdable payments, in a way that chapter cuatro withholding can get apply absent an exception out of withholding below chapter cuatro. Reporting criteria to own wages and you can withheld taxation paid off so you can nonresident aliens.

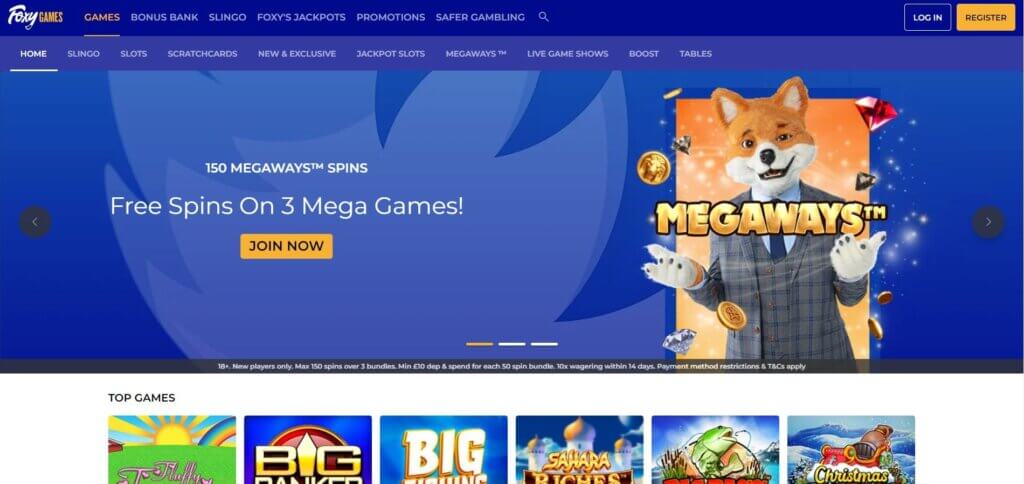

$5 deposit casino grim muerto | Minimal Deposit Criteria to have a mortgage

You should render evidence you have a deposit away from at the minimum 5% of your own cost of the house we should get or create. To be eligible for the initial house grant, people have to have shown typical contributions with a minimum of minimal matter on their KiwiSaver for three or maybe more many years. If you are joining with no less than one borrowers so you can buy a property, you’ll have a blended household earnings as much as $150,100 (before income tax) within the last 1 year. To find property is a significant dream for the majority of, but rescuing to possess a deposit will be difficult – especially in cutting-edge climate. However, within The fresh Zealand our very own government’s First Financial initiative, entitled “First Financial” also offers a beacon away from hope, making it possible for eligible homeowners to find their dream home with in initial deposit as low as 5%. Our postings are often remain mission, independent, effortless, and you can free of bias.

popular fixed dumps to have NRIs

Ensure that you provides a section from the $5 deposit casino grim muerto lease from the brand new put and also have the resident signal otherwise initial you to section because the an acknowledgment that citizen knows their particular legal rights. A good. More often than not, a property owner never charges several day’s lease while the a protection deposit. The newest deposit can’t be used alternatively to your last month’s lease except if the newest property manager gets the new resident authored consent to accomplish this.

Can i make Overpayments on my home loan? A guide to home loan overpayments

- The united states features frozen the brand new process from part 1, subparagraph (g), from Blog post step three of the Conference.

- A great mediator knows lenders conditions to have self-working anyone, and thus is ensure that your software is steered in order to a loan provider comfortable with your circumstances.

- Whether or not numerous people could be withholding agents to have one payment, an entire income tax is needed to become withheld only once.

- Although not, under particular things, fee private functions did in the usa is not sensed money of offer within the All of us.

- That have a smaller sized deposit specifications, these mortgage loans build owning a home more obtainable for most people whom you will if you don’t struggle to rescue the conventional 10% to 20% deposit.

- If you’re able to help save to have a more impressive deposit (a great 10% otherwise 20% sum), you’ll have probably use of lower rates of interest, definition you’ll shell out quicker for your assets ultimately.

You ought to opinion the new withholding statement available with Mode W-8IMY and may also maybe not have confidence in guidance on the declaration so you can the new the total amount all the details doesn’t contain the states made for an excellent payee. You do not remove a payee while the a foreign individual when the an excellent U.S. address is offered to the payee. You might not lose a guy as the a citizen away from a great nation in which the usa have a taxation pact if the target for the body’s outside of the treaty nation. The fresh WP can be elect to declaration payments made to its overseas direct lovers for the an excellent pooled reason behind section 3 intentions alternatively than simply reporting money to each and every direct mate in addition to revealing costs in the a chapter 4 withholding price pool for the the total amount the newest WP try permitted to get it done considering the part 4 status.

When you’re and make payments so you can an excellent WP for section 3 or cuatro aim, there is no need to help you withhold if your WP is actually acting in this skill. The new WP have to imagine first sections step three and you can 4 withholding obligations to possess amounts that will be distributed to, or included in the distributive show from, any lead companion and may also guess sections step three and you may cuatro withholding commitments definitely of its secondary people. A WP should provide your that have a questionnaire W-8IMY you to definitely certifies your WP are acting in that ability and provides some other advice and you will certifications necessary for the form. Thus, an enthusiastic NQI should provide your having allocation advice for the You.S. nonexempt receiver perhaps not utilized in a part 4 withholding price pond from U.S. payees before NQI can make a cost..

Debt maybe not inside entered function and you will financial obligation given just before March 19, 2012. Certain quantity paid back, personally or ultimately, on the supply away from a promise of indebtedness given immediately after Sep 27, 2010, are from U.S. source. Quite often, the occasions the fresh alien is within the Us because the a good teacher, scholar, otherwise trainee on the a keen “F,” “J,” “M,” or “Q” visa aren’t measured. Visit Internal revenue service.gov/Versions to help you down load most recent and you may prior-seasons models, guidelines, and courses.

Best Mortgage loans to possess Pilots Financial advice for Aviation Professionals

As the a great withholding agent, you are in person liable for one tax required to end up being withheld. That it responsibility is independent of the tax liability of one’s foreign person to whom the new percentage is established. If you’re unable to keep back plus the foreign payee fails to fulfill their You.S. taxation accountability, next you and the newest international person is actually responsible for tax, and interest and you may one appropriate penalties. This type is used showing the amount of ECTI and one withholding taxation payments allocable so you can a foreign partner to the partnership’s income tax year. At the conclusion of the fresh partnership’s income tax seasons, Form 8805 should be taken to for every overseas mate for the whose account taxation below section 1446 try withheld otherwise whoever Form 8804-C the partnership experienced, even though people withholding tax try paid off. It ought to be brought to the fresh foreign partner because of the owed date of your own union get back (as well as extensions).

For information about the form 8966 e-filing criteria, such as the tolerance go back constraints, to own loan providers and all of other agencies having an application 8966 processing demands, find Electronic processing specifications and how to file digitally on the Guidelines to possess Mode 8966. When the March 15 drops to your a tuesday, Weekend, otherwise judge escape, the newest due date is the second business day. If you cannot create an important put inside the date given, a penalty try imposed for the underpayment (the additional of the expected deposit more than any real fast deposit to own a period of time). You could potentially steer clear of the penalty when you can show that the newest incapacity so you can put is actually to possess practical trigger rather than on account of willful neglect. While the Internal revenue service cannot issue ITINs on the Weekend, the fresh local casino pays $5,one hundred thousand in order to Mary instead withholding U.S. taxation. The newest casino need, on the following Monday, fax a completed Setting W-7 to own Mary, such as the required degree, to the Irs to have an enthusiastic expedited ITIN.

- (i) This consists of making certain the brand new resident is receive proper care and you will services securely and this the newest actual build of your own facility maximizes resident liberty and won’t pose a safety risk.

- It’s important because they reduces the matter you will want to use and shows lenders you’re also significant and you can economically open to the borrowed funds your’re requesting, which can lead to best interest rates.

- Comprehend the Guidelines to have Setting 8804-C to possess after you need install a duplicate of this function to form 8813.

- A move may appear whenever a partnership delivery contributes to obtain lower than part 731.

- Withholding is necessary from the a man aside from the fresh issuer from an obligation (and/or issuer’s representative).

You must not already individual one home otherwise assets – as well as possessions owned by a partner or de facto mate you to definitely you could fairly be likely to reside in otherwise sell. Reaching homeownership might be difficult, but the Basic Mortgage, combined with commitment and strategic thought, produces that it dream a reality for some ambitious homeowners. Including also provides are made to attention and retain people on the a great aggressive world. With regards to on the web wagering, 100 percent free bets are among the extremely enticing incentives readily available. They give a method to lay bets without the need for your own money, providing you the chance to victory a real income. Yet not, understanding the particulars of totally free bets is important therefore you might taking advantage of him or her.